Will the Housing Market Turn Around This Year?

Today, many people are asking themselves if they should buy or sell a home in 2020. Some have shifted their plans or put them on hold over the past couple of months, and understandably so. Everyone seems to be wondering if the market is going to change and when the economy will turn around. If you’re trying to figure out what’s going to happen and how to play your cards this year, you’re not alone.

This spring in the 2020 NAR Flash Survey: Economic Pulse, the National Association of Realtors (NAR) has been tracking the behavior changes of homebuyers and sellers. In a reaction to their most recent survey, Lawrence Yun, Chief Economist at NAR, noted the beginnings of a turn in the market:

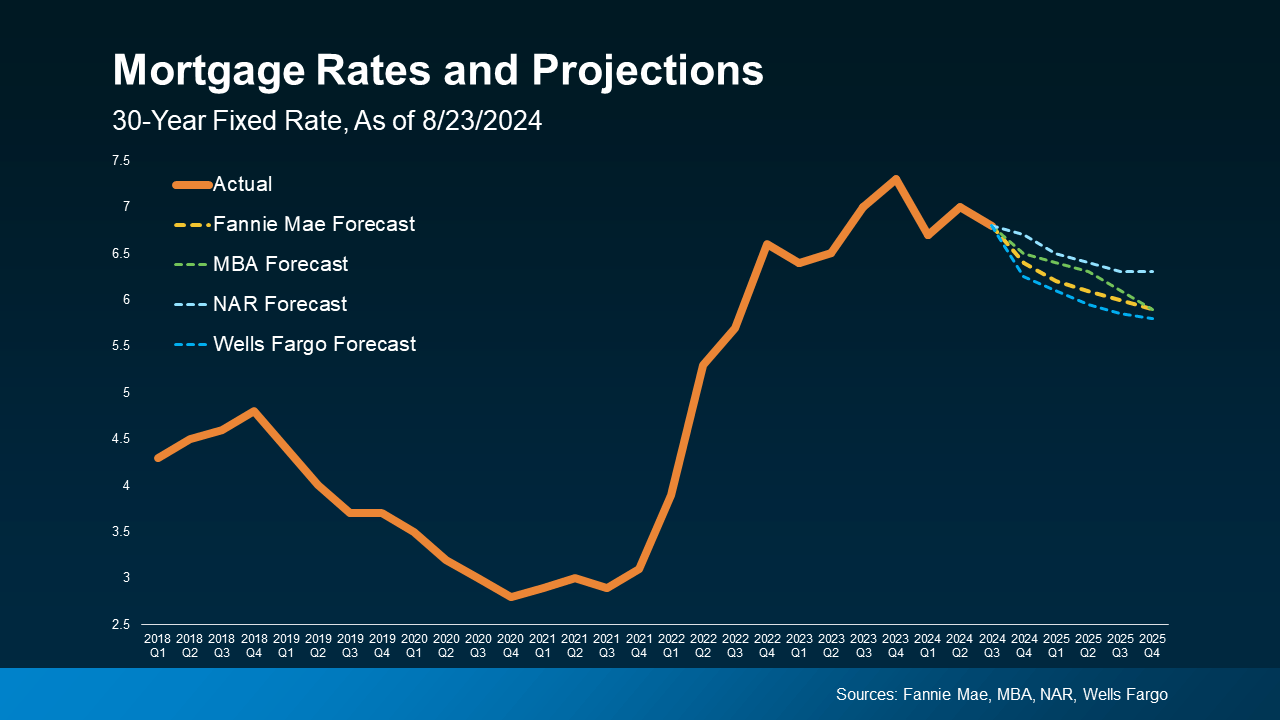

“After a pause, home sellers are gearing up to list their properties with the reopening of the economy…Plenty of buyers also appear ready to take advantage of record-low mortgage rates and the stability that comes with these locked-in monthly payments into future years.”

What does the survey indicate about sellers?

Sellers are positioning themselves to make moves this year. More than 3 in 4 potential sellers are preparing to sell their homes once stay-at-home orders are lifted and they feel more confident, which means more homes will start to be available for interested buyers.

Just this week, Zillow also reported an uptick in listings, which is great news for the health of the market:

“The number of new for-sale listings overall has shown improvement, up 5.9% last week from the previous week. New listings of the most-expensive homes…are now seeing the biggest resurgence, up 8%. The uptick is likely a sign sellers are feeling more confident because of improving buyer demand, as newly pending sales have also jumped up during the same period.”

What does the survey note about buyers?

The recent pandemic has clearly impacted buyer preferences, showing:

- 5% of the respondents said buyers are shifting their focus from urban to suburban areas.

- 1 in 8 Realtors report changes in desired home features, with home offices, bigger yards, and more space for their families becoming increasingly important.

- Only 17% said buyers stopped looking due to concerns about their employment or loss of a job.

As we’ve mentioned before, buyer demand is strong right now, and many are simply waiting for more inventory to become available so they can make a move, especially as the country begins to reopen.

Bottom Line

If you’re thinking about putting your house on the market, there’s a good chance an eager buyer is looking for a home just like yours.

Share