Why Is It So Expensive To Add A Front Porch To Your Home?

One of the most common requests we receive in new homes is the front porch. Be it a small stoop to keep packages dry until you get home, or a grand front deck to sit and relax on, a porch immediately adds character and charm to any house. Sometimes customers are a little caught off guard by the price tag associated with these pieces, so today we wanted to take a little time to add up and explain the costs of adding a porch to your home.

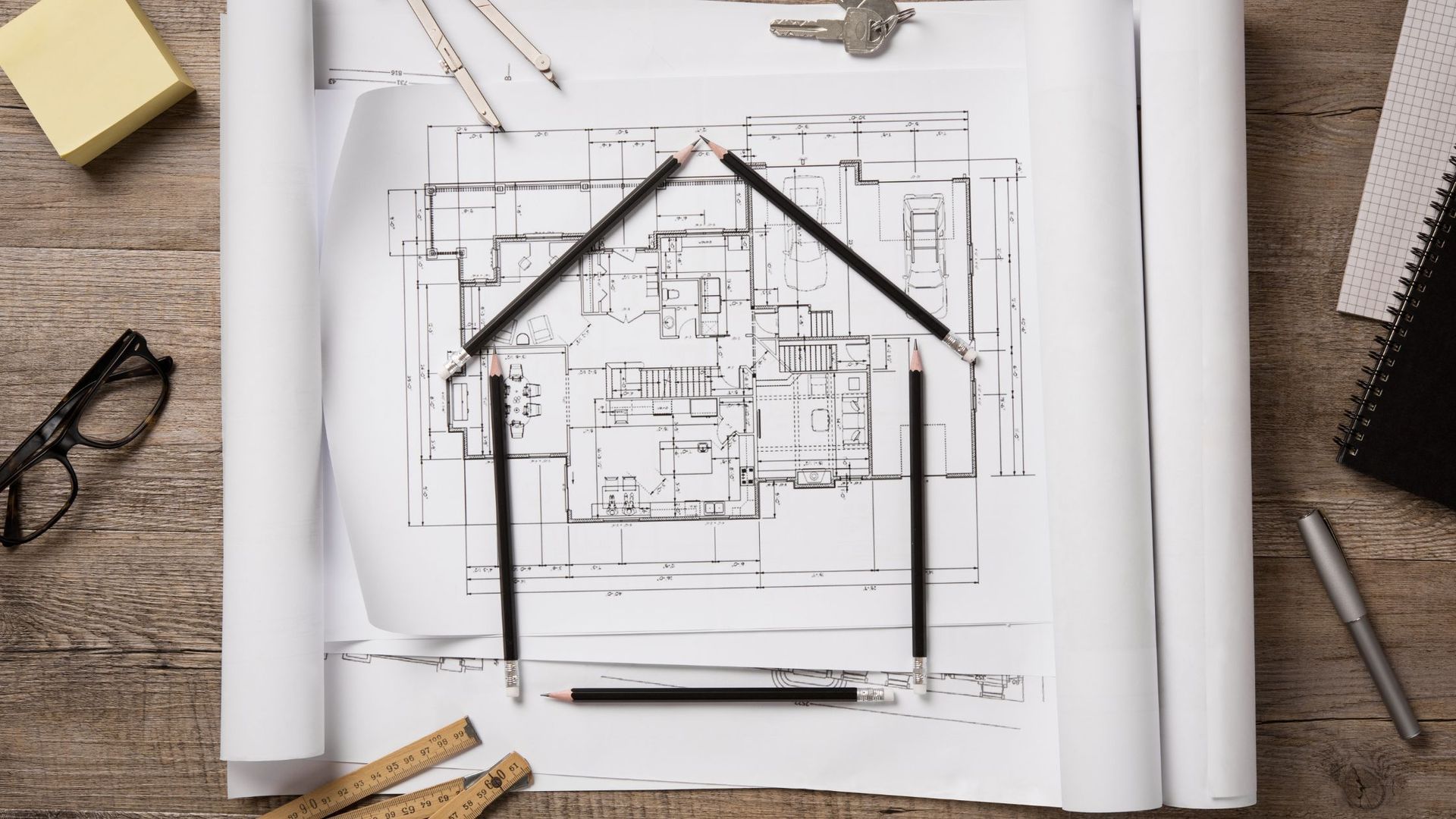

Ultimately, the thing to remember when you’re considering adding a porch to your new home, is that for all intents and purposes, it’s really just another room on your house. While there may not be any heating or sheetrock going in, just about every other step of the process is the same. Just like with any other room in your house, attaching a porch involves installing a footing, framing the entire structure, running electrical work for the lighting and any outlets you may require and finishing the wood. What sometimes appears a rustic or simple addition, is ultimately, still an addition.

This is by no means to say though that building a porch is a bad idea! Quite the contrary, a porch can be one of the most valuable additions a homeowner can make. Besides the tremendous curb appeal, a porch can dramatically increase your living space without adding to heating and cooling costs. Additionally, roughly 80% the cost of building a porch is added onto property value should you ever decide to sell your home.

Whether you’re looking to improve your curb appeal or simply for a place to relax after a hard day at work, a porch is an incredible addition to most any home. Though perhaps a little dizzying at first shrug, for many, the benefits dramatically outweigh the costs.

Share