How to Sell Your House Part 3: Smart Tips For Getting Your House In Tip-Top Shape For Resale

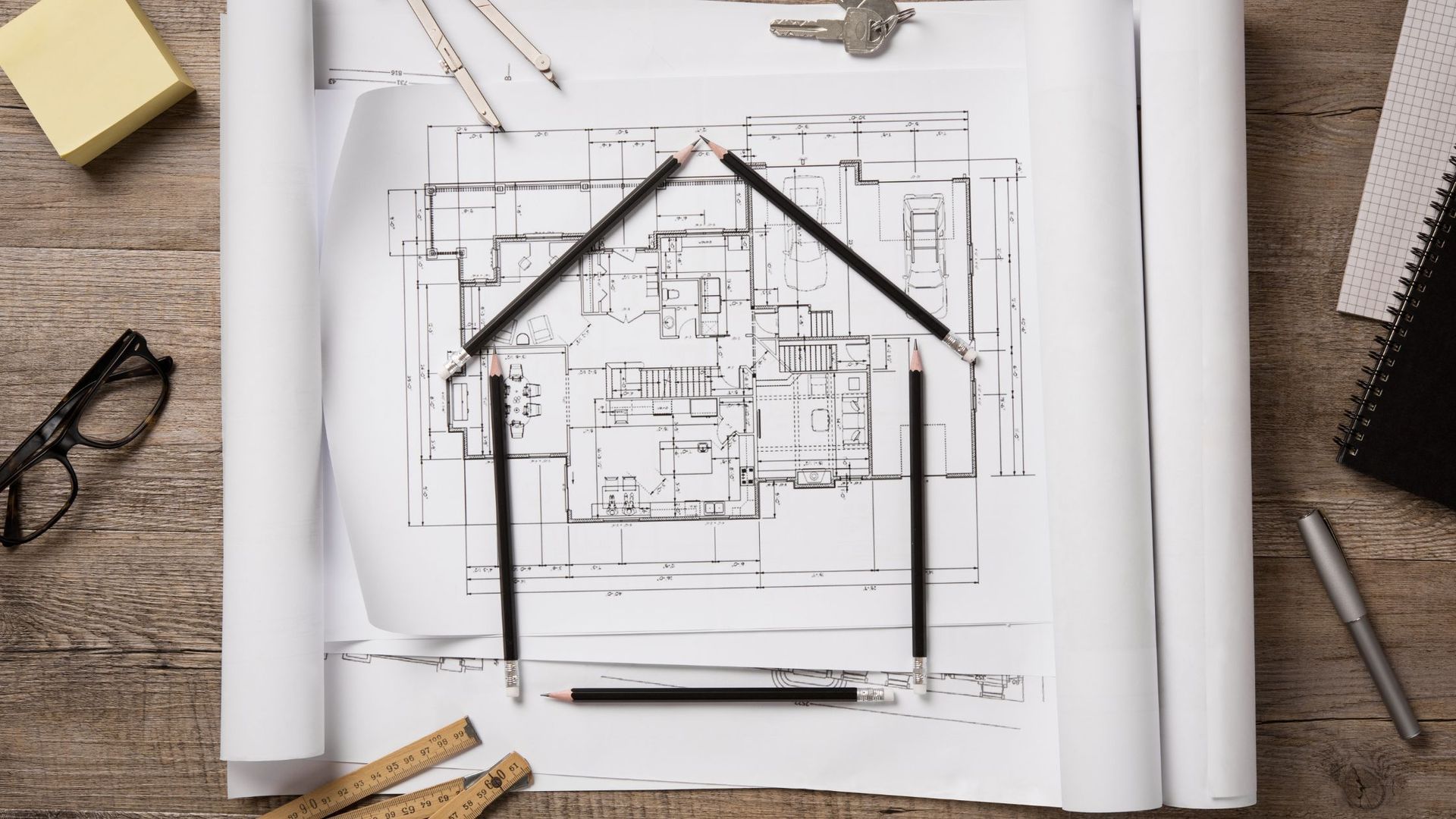

We’ve talked about the simple and common steps everyone should take to get your home ready for sale, but what if your house is in need of something a little more involved? Selling your property when it requires repair or renovation can lead to hugely inflated costs and major delays down the road. Today, we’ll discuss the steps you can take to ensure that your house is in prime shape for the resale market.

It’s critical that you get your house inspected before you even talk to a real estate agent. Any issues your buyer happens across in their own inspection is just leverage in the negotiating process. Taking care of repairs yourself gives you the ability to shop around and ensure the best available rates. Giving yourself a clean bill of sale is a preemptive strike in ensuring the best possible return on your investment.

While generally speaking, major makeovers and renovations aren’t worth the hassle when it comes to selling your house, the kitchen is the one exception. It’s an old broker’s saying that “you aren’t selling the house, you’re selling the kitchen” and really, there’s a lot of truth there. The kitchen is the most considered room in the house to potential buyers and also the most scrutinized. $2,000 may seem like a lot to spend on a new stainless steel refrigerator, but when your buyer wants to knock $10,000 off your asking price because “the kitchen seems dated”, it really pays for itself. Even just one new appliance can bring a fresh and updated feel to the room. If your kitchen looks like it was remodelled in the past decade, you probably don’t have anything to worry about, but shy of that consider replacing your kitchen hardware or repainting your cabinets to bring a more modern look to the room.

In a perfect world, your house will be ready to sell right out of the gate and require no real repair. Should anything need work though, taking care of it early will pay terrific dividends down the road. Getting your home inspected early and considering some kitchen updates can go a long way in securing the sale price you deserve.

Share